AUTO THEFT

THE TOPIC

Auto theft is covered under the comprehensive section of an auto insurance policy. Theft coverage applies to the loss of the vehicles as well as parts of the car such as air bags. Comprehensive coverage, which is not mandatory, also pays for fire, vandalism and weather-related damage including damage from flooding and earthquakes.

Premium rates for comprehensive insurance are affected by the risk of loss, meaning the likelihood that an insured car will be stolen or damaged and the car’s value at the time of the loss. The dollar size of claims has been going up, reflecting the higher value of new cars on the road, the value of the cars that are targets for theft or are damaged and the cost of vehicle bodywork. Vehicle bodywork costs include replacing stolen components. Nationally, more than 75,000 airbags are stolen every year.

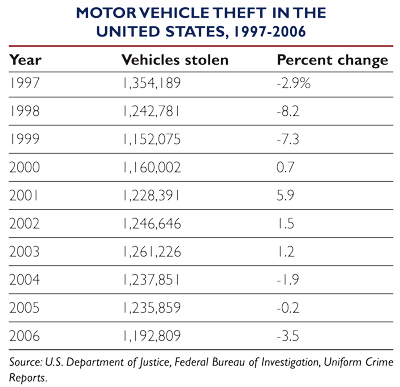

According to the Federal Bureau of Investigation, the number of U.S. motor vehicle thefts decreased by 3.5 percent from 2005 to 2006, the third consecutive annual decrease. In 2006 the value of stolen motor vehicles was $7.9 billion. The average value of a motor vehicle reported stolen in 2006 was $6,649.

KEY STATISTICS

- 2006 Theft Statistics: According to the Federal Bureau of Investigation (FBI)'s Uniform Crime Reports, a motor vehicle is stolen in the United States every 26.4 seconds. The odds of a vehicle being stolen were 1 in 207 in 2005 (latest data available based on registrations from the Federal Highway Administration, thefts from the FBI and calculated by the Insurance Information Institute). The odds are highest in urban areas.

- U.S. motor vehicle thefts fell 3.5 percent in 2006 from 2005, according to the FBI's Uniform Crime Reports. In 2006, 1,192,809 motor vehicles were reported stolen.

- Western states accounted for the largest share of thefts— 36.8 percent, followed by the South at 34.6 percent. The Midwest accounted for 18.5 percent of thefts and the Northeast for 10.2 percent.

- Nationwide, the 2006 motor vehicle theft rate per 100,000 people was 398.4, down 4.4 percent from 416.8 in 2005. The highest rate was reported in the West, 632.1, down 7.6 percent from 684.5 in 2005. The rate of motor vehicles stolen was 378.1 in the South, down 1.4 percent from 2005; 332.6 in the Midwest, down 2.8 percent; and 222.3 in the Northeast, down 6.6 percent.

- Only 12.6 percent of thefts were cleared by arrests in 2006.

- Carjackings occur most frequently in urban areas. They account for only 3.0 percent of all motor vehicle thefts.

- The average comprehensive insurance premium in the U.S. fell 2.5 percent from 2004 to 2005, the most recent data available, to $143.28, according to the National Association of Insurance Commissioners.

RECENT DEVELOPMENTS

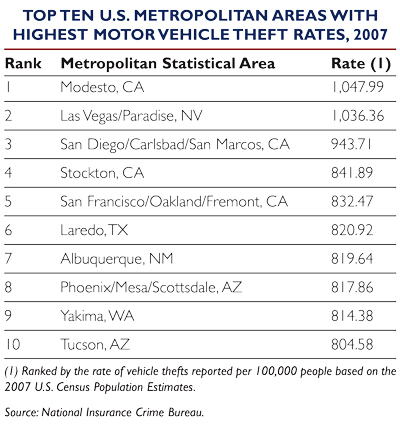

- Thefts By City: According to a National Insurance Crime Bureau (NICB) study released in April 2008, the Modesto, California Metropolitan Statistical Area (MSA) had the highest rate per capita for vehicle thefts in the nation in 2007. Four of the top 10 U.S. MSAs for vehicle theft in 2007 were in California, as shown below:

- According to NICB, preliminary 2007 crime data released by the FBI in January 2008 show that 2007 is on track to be the fourth consecutive year of declining vehicle thefts. If the preliminary figure of -7.4 percent holds, it will be the largest single year percent drop in thefts since 1999 and will contribute to the overall 11 percent reduction in vehicle thefts, nationally, since 2000.

- A survey conducted in April 2007 on behalf of the National Insurance Crime Bureau (NICB, https://www.nicb.org) and LoJack, a manufacturer of an electronic vehicle tracking and recovery system, found that almost four out of five Americans (79 percent) always lock their vehicles and that nine out of ten (93 percent) never leave spare keys in their vehicle. However, a third admit they have left their car while it was running, which makes the vehicle an easy target for theft.

The survey also found that 47 percent of Americans don’t always park in a well-lit area and 40 percent don’t hide their valuables. In fact, nearly half leave mail in their vehicle, a quarter have left a purse or wallet, and almost a third have left bank statements, all of which can put them at risk for identity theft.

Although 75 percent of respondents know that there are costs associated with vehicle theft in addition to paying the insurance deductible and the cost of replacing the vehicle that are not covered by insurance, virtually none (one percent) knew that there are additional costs such as insurance premium increases, the cost of time spent dealing with police, vehicle rental costs, and the cost of time off from work. The survey was conducted by Opinion Research Corporation.

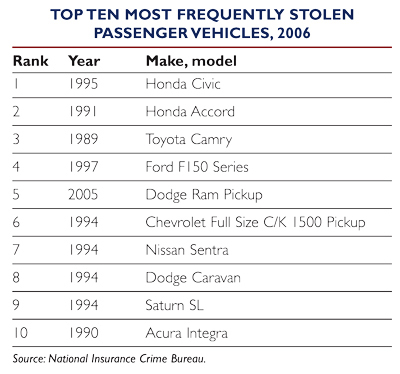

- Thefts By Model: The NICB says that the 1995 Honda Civic was the most stolen vehicle in 2006. Motor vehicle thieves continue to target imports over domestic brands. Most of the vehicles on the top ten list shown below are 10 or more model years old. These cars have been consistent top sellers for many years and some of their parts are interchangeable. Thieves dismantle them for their components. The NICB compiles its list using National Crime Information Center data, which is based on police reports.

- According to the NICB, California has the highest vehicle thefts in the United States.

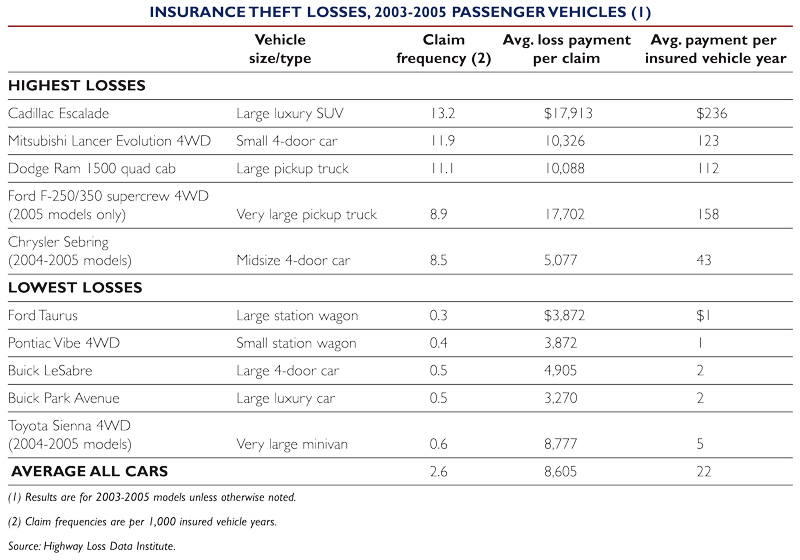

- The Insurance Institute for Highway Safety’s Highway Loss Data Institute (HLDI) says that the 2003 to 2005 model year Cadillac Escalade has the highest rate of insurance theft claims. HLDI identifies vehicles with the worst losses by counting the number of claims by make and model relative to the number of each model insured. The vehicles with the highest and lowest losses are shown below:

Motorcycles: The National Insurance Crime Bureau (NCIB) says that nationally 70,613 motorcycles were stolen in 2005, down 0.7 percent from 71,108 in 2004. This represents a loss of over $434 million to motorcycle owners and the insurance industry. California tops the state list for motorcycle thefts in 2005. The top 10 states are as follows:

BACKGROUND

Federal Antitheft Legislation: Federal intervention against car thieves began in 1919 with passage of the Dyer Act that made interstate transportation of stolen vehicles a federal crime.

In 1984, Congress took a major step in the war against auto theft. It passed the Motor Vehicle Theft Law Enforcement Act, a law designed to thwart professional car thieves and chop shops by making it more difficult to sell stolen vehicles and parts, both domestically and overseas. The law toughened penalties by bringing parts under federal racketeering statutes and by imposing heavy fines and prison terms for export violations. It also sought to dry up the illegal used parts market by requiring manufacturers to stamp identifying numbers on major car components, making it easier to trace parts taken from vehicles stolen for dismantling.

The Act also required that vehicles be made available for inspection prior to export and expanded U.S. Customs officials' powers of inspection and arrest in response to the growing international nature of motor vehicle theft. Cars and parts of cars stolen in the United States often wind up on overseas markets. Insurers or their designated agents are required to inform the Secretary of Transportation of vehicle theft and recovery and rating data used to set insurance premiums for motor vehicles.

Another 1984 federal law sought to prevent professional criminals from using counterfeit documents to dispose of stolen vehicles on the legitimate market by making it a federal offense to counterfeit or forge motor vehicle title certificates. In 1985, the DOT required that for post-1986 model year cars, 14 major parts of vehicles be inscribed with a 17-digit vehicle identification number (VIN). The rule was relaxed somewhat for imported vehicles.

The Anti-Car Theft Act was enacted in 1992 in an effort to reduce the number of car thefts nationwide by making armed auto theft ("carjacking") a federal crime. In 1994, the passage of the Violent Crime Control and Law Enforcement Act made carjacking resulting in death a federal crime punishable by death. Other provisions of the 1992 law extended the program, requiring the marking of 14 major parts in all cars including imports.

Under the Act, repair shops that sell or install marked used parts must check VINs against the FBI’s stolen car database through a national clearinghouse or risk fines. Additional provisions provided start-up funding linking all state motor vehicle departments to ensure access to titles; required states to check VINs of out-of-state cars before issuing a title to a new owner; required the Customs office to perform spot checks of cars and containers leaving the country; began a pilot program of xraying containers to prevent the export of stolen vehicles; required insurers to certify that the salvaged or junked vehicles they sell are not stolen; and established a grant program for state and local anti-car-theft committees funded by car taxes or fees.

In response to Title II of the Anti-Car Theft Act combating title fraud, the National Motor Vehicle Title Information System was designed, tested and improved. The system enables jurisdictions to verify the validity of titles prior to issuing new ones, thus helping to reduce title fraud and theft. It also curbs fraud associated with junk or salvage titles by including this data in the system, preventing the sale of salvaged vehicles without disclosing this information.

The Anti-Car Theft Improvements Act of 1995 upgraded state motor vehicle department databases containing title information to facilitate their use by federal and state law enforcement officials. The responsibility for implementing the electronic system, which was intended to enable users to instantly determine if a motor vehicle is stolen, was transferred to the Justice Department. The Act grants limited immunity from civil liability to the providers of titling information.

According to the American Association of Motor Vehicle Administrators, which manages the National Motor Vehicle Title Information System, as of November 2007, only 13 states had integrated the system’s online transactions into their titling systems. However, 12 states had provided files of all active titles and brands to the system in batches that need to be updated. Five more states are developing online or batch systems. The system, which has the potential to track all vehicles by their vehicle identification numbers (VINs), could be a tool valuable in terrorism-related investigations. The 1993 World Trade Center bombing was solved when authorities traced the truck which exploded by its VIN to its owners.

Other Measures To Combat Auto Theft: The National Insurance Crime Bureau (NICB) combats auto theft by investigating cases referred to it by insurers and through its online databases. The databases allow member insurance companies to search files by driver identification data and also by license plate numbers, VINs, and component vehicle part and type numbers. Information leading to the identification of the vehicle used in the World Trade Center bombing of 1993 was obtained through an NICB database, which allows the user to enter a partial VIN. The complete VIN was reconstructed and matched to a van stolen from a truck rental company on the day of the bombing.

In November 2007 the NICB announced that it had made its VINCheck search service available to the public. The service is a free Unrecovered Stolen Vehicle Database that can determine if a vehicle has been reported stolen by one of NICB’s 1,000-member insurance companies. The NICB says that since over a million vehicles are stolen each year and the recovery rate is just 63 percent, the system may help prevent buyers from inadvertently purchasing a stolen vehicle.

In December 2007 the NICB announced its vehicle location and recovery program for companies that finance vehicle loans. The program helps these companies locate stolen, illegally exported, abandoned and impounded vehicles. The NICB, through its data-sharing agreement with the FBI’s National Crime Information Center and its internal data analytics and investigative capabilities, can notify the companies about recovered stolen and impounded vehicles and those exported or relocated to foreign countries.

The NICB has three primary programs to aid finance companies: an impound service to gather information and cross reference it with finance company vehicle data; interdiction services to help stop the flow of stolen U.S. vehicles on foreign black markets, in conjunction with U.S. Customs and Border Protection agents; and repatriation services, where the NICB locates, identifies and returns stolen or impounded vehicles from foreign countries.

In the 1980s, states and regions experiencing high auto thefts began to form Anti-Car Theft (ACT) groups funded by voluntary grants from coalitions of law enforcement groups, state funds, insurers and consumers to promote public awareness of vehicle theft and lobby for the passage of state legislation aimed at combating thefts.

As of November 2004, 13 states (Arizona, California, Colorado, Florida, Illinois, Maryland, Michigan, Minnesota, New York, Pennsylvania, Rhode Island, Texas and Virginia) have enacted Automobile Theft Prevention Authorities (ATPAs), mostly funded by a small surcharge on drivers licenses or registration fees, or on auto insurance policies sold in the state.

Michigan pioneered the ATPA concept in 1986, allocating $1 from each auto insurance policy and channeling the funds toward combating auto theft. Michigan's program, called Help Eliminate Auto Theft (HEAT) includes a toll-free hotline for residents to report thefts and chop shop operations. Since the program’s inception in 1985 through 2006 HEAT has recovered more than $43 million in stolen property, awarded $2.0 million in rewards and helped arrest nearly 3,000 auto theft criminals.

ATPAs and other states that have formed ACT groups use a wide range of programs to fight auto theft in addition to the HEAT hotline programs. Combat Auto Theft (CAT) programs involve auto owners who voluntarily put stickers on their windshields that alert police that they can stop the car for a theft check after a certain hour. High-theft metropolitan areas have instituted task forces to combat auto theft. In Newark, New Jersey, a task force helped reduce the city's theft rate from the highest in the United States in 1991 to sixteenth in 1996.

Component Theft: More than 75,000 air bags are stolen every year, according to estimates by the Insurance Information Institute. NICB says that air bag theft costs insurers and vehicle owners more than $50 million a year. New air bags cost about $1,000 from a car dealer; on the black market the cost is between $50 and $200. To thwart thieves, steering wheel covers used with a steel bar steering wheel lock are available. New York combats air bag theft by requiring accident reports to note air bag deployment, and specifies procedures for auto repair shops to follow when replacing stolen or deployed air bags. Xenon headlights are another component now popular with thieves. Global positioning systems may be the next component targeted, industry observers say.

New Technology: Insurers and organizations such as the NICB emphasize the importance of keeping ahead of increasingly savvy professional auto thieves. Marking vehicles’ major parts is mandated by the U.S. Department of Transportation’s National Highway Traffic Safety Administration.

Some auto manufacturers have sprayed microdots, which are impossible to remove, onto auto parts. About 10,000 tiny dots, containing a unique identification code, are sprayed on each part. License plate reading technology has been used at U.S. borders with Canada and Mexico to track vehicles entering and leaving the country. A mobile version that can read about 1,000 license plates an hour can be placed in police vehicles. Vehicle cloning is a scam that involves criminals using a vehicle identification number (VIN) from a legally owned vehicle on a stolen vehicle of a similar model.

According to the NICB, the number of vehicle clonings has steadily risen since 2001 and by 2007 accounted for more than $36 million in fraudulent vehicle transactions. To combat the crime, the NICB has partnered with Experian Automotive to use the latter's AutoCheck vehicle history reporting system. The system can check suspect VINs in the National Vehicle Database, which contains information on about half a billion vehicles. The NICB then investigates the suspect VINs with the help of law enforcement agencies.

Consumers spend hundreds of millions of dollars on vehicle security devices. Electronic tracking devices such as LoJack use a hidden transmitter to allow police to track the vehicle. (LoJack, which operates in 26 states and the District of Columbia claims a better- than 90 percent recovery rate.) These tracking devices not only help police find individual stolen vehicles but lead them to chop shops, thwart the export of stolen motor vehicles and lead to the recovery of expensive construction vehicles as well as passenger cars. Some insurers offer their policyholders a LoJack tracking system at a discounted price along with premium discounts.

Insurer Discounts: According to the National Association of Insurance Commissioners, in nine states (Florida, Illinois, Kentucky, Louisiana, Massachusetts, Minnesota, New Mexico, Pennsylvania and Rhode Island) regulations require insurers to provide car owners with discounts on the base rates for comprehensive insurance for antitheft devices. In four other states insurers may offer these discounts or are encouraged to offer them. The amount of the discount varies but is typically 15 to 20 percent for passive devices, which are automatically activated when the vehicle is locked. Massachusetts residents are eligible for a minimum 25 percent discount if they have both an antitheft device and an auto recovery system (see New Technology above), and some combinations of devices can result in a 36 percent discount. Insurance companies in states that do not mandate discounts, such as Georgia, New Jersey, New York and Washington, encourage car owners to install antitheft devices by voluntarily providing discounts.

© Insurance Information Institute, Inc. - ALL RIGHTS RESERVED

© 2015 TLC Magazine Online, Inc. |